I had a conversation with some heavy hitting financial professionals (who will remain nameless for confidentiality purposes) a couple of weeks back regarding the recent price depreciation in Coffee with relation to the companies that are affected by the commodity due to their exposure in the industry they reside. The initial portion of the conversation was made up of discussing the technical aspect behind the Coffee move, eventually leading to a discussion between who had more upside during 2013: Starbucks (Ticker: SBUX) or Dunkin’ Brands (Ticker: DNKN). Over drinks, the companies internal structures began to get broken down: SBUX locks in their commodity prices a year out to avoid any extreme volatility, and DNKN… Well… How exactly does that company control their Coffee commodity risk? The conversation ended, the drinks continued, and the evening was a phenomenal one; it got me thinking, however, about the dilemma we ran into during our discussion about DNKN and how they indeed monitor risk. Based on this evening and following a simple risk assessment and the known fact that earnings were right around the corner (the initial Whisper Date being February 8, 2013, prior to the official company announcement of January 31, 2013 @ 8:00am ET), I got long eight contracts of DNKN February 2013 37.50 Calls at $0.30 and began delving into the company’s fundamental picture.

Let’s break down the Coffee industry as a whole before we get into DNKN’s specifics. As a common misconception, many people think that Coffee is a bean when in fact it is a berry that a bean comes from; instead of coming from the ground, it’s actually a hanging piece of fruit that is more like a seed than a bean. The most heavily picked, produced, and roasted species of this particular fruit is the Arabica coffee bean, which is what many of the leading coffee supplying fast-food joints (including McDonald’s, leaving SBUX and DNKN alone) and suppliers of K-Cup producers (the leader being Green Mountain Coffee Roasters) use. The Arabica bean is what the Coffee contract on the ICE and CME track (Contract: KC_#), with the second most-produced bean, the Robusta bean, being tracked on the NYSE Liffe. Both of these particular beans are most popularly produced in Latin America, and similar to fine wines, need a particular soil and climate in order to get the best quality. Because Arabica makes up 70% of the world’s coffee production, the first thing I wanted to see is how the KC contract compared to DNKN’s percentage performance since the company’s IPO in late July 2011:

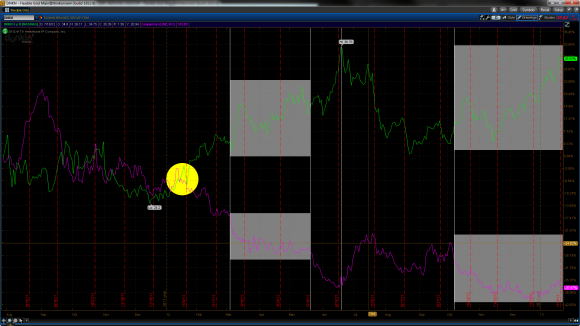

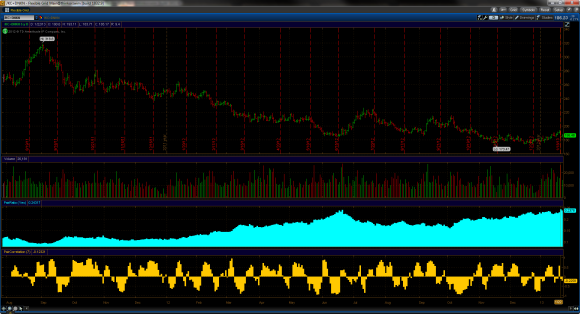

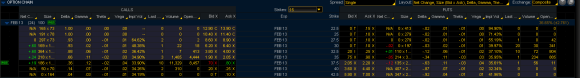

This is where we can see the clear inversion at the turn of 2012 that took place (denoted by the yellow circle) and two particular inverted price areas that struck me as interesting. From March to May, the price appreciation of DNKN stock was approximately 10%, where as after an initial drop off in the price in Coffee, we see a tight price fluctuation and a breakdown that occurred throughout most of June. Over a time period that is two times longer, from October 2012 to present, we see close to a 20% move in the DNKN price and a tight price fluctuation that has yet to truly blow out in Coffee. The question is whether or not Coffee has anymore room to move lower, and if it does, how low will it go and will a further price decline result in DNKN’s stock price moving higher? We can get a completely different picture of this correlation through a paired chart over the same time period:

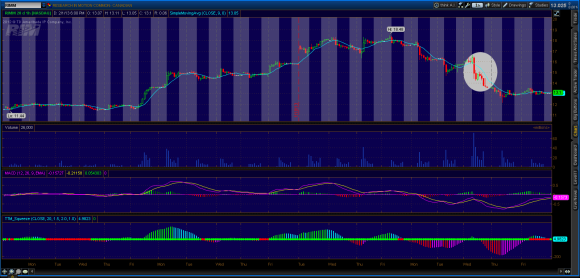

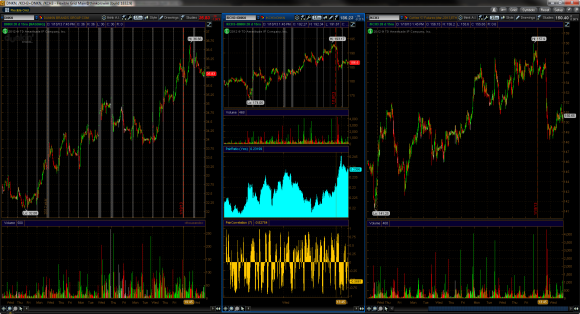

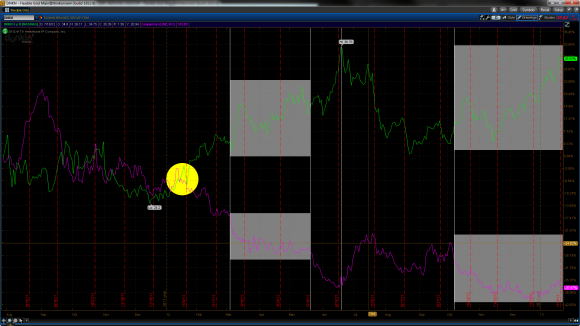

Looking at the Pair Ratio indicator (teal), we can see that over the price depreciation in Coffee, the ratio became tighter and tighter. On the slight Coffee rally, the ratio backed off and the price of DNKN stock, as you saw from the previous chart, pulled back with the ratio. We’re currently at a Pair Ratio level that has been accurate on calling DNKN stock tops in the past, but with earnings approaching next week and a similar pattern we’ve seen in before, the probability of a DNKN stock spike before the stock pulls back is more likely on a bullish earnings report. The most recent price activity from yesterday’s close on a 15 minute, 20 day time frame can be seen below:

Through my trusted resources regarding the most recent prices of a DNKN coffee (also known as close friends who can’t go a day without having three cups), a 12-ounce “Cup of Joe” will run you about $1.95. DNKN has research from the National Coffee Drinking Trends Study (2004) that shows statistics of approximately 2.7M cups of coffee being sold a day by the company. What does simple math tell us about this? That DNKN makes sales revenue every day, ceteris paribus of all costs, of about $5.27M. If you REALLY want to extrapolate the data and figure that DNKN franchises are open 350 days a year, we see a yearly sales revenue of $1.8B. DNKN had revenues in fiscal year 2011 of approximately $628M, and so far through three quarters of fiscal year 2012, the company has put up $496M in revenues; through another extrapolation, the company should be on par for matching revenues from last year with the possibility of a slight beat being great. So, where does the company really take the cake on becoming a growth play for this upcoming quarter?

Two words: franchise expansion. DNKN CEO Nigel Travis announced not only a new push to expand on the West Coast of the United States, the most recent expansion announcement from the company, but also overseas to expand in the Chinese and Indian market. Both expansions are set for 2013, but the company’s expansion growth so far is close to 4.00% in the United States for this past year. With their push to move the brand internationally, the company is making huge strides and is cutting their cost through franchising the operations… And how do the franchises and the company as a whole control their commodity costs, their biggest burden as connected as they are to the Coffee commodity? They outsource the production of coffee beans to the National DCP: the franchise pays the supply chain manager for services, DNKN pays the supply chain manager a set fee, and the game of fiddling with commodity prices is handled by the middleman entity.

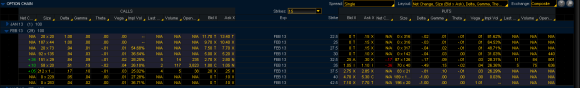

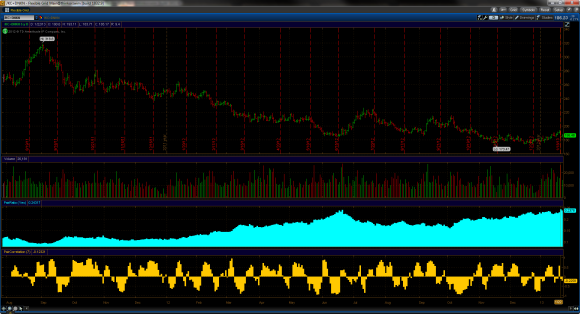

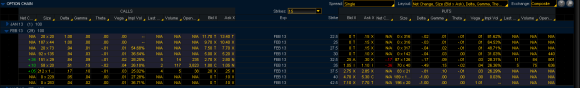

In the anticipation of this earnings report, someone has become incredibly bullish on the stock within the February options chain. On the day before the contract rollover last week, we saw typical, very illiquid activity in the February 2013 37.50 Calls and I thought nothing of the premium fluctuation back to my entry price as DNKN underlying stock had rallied on the decrease in price of Coffee. I added another four contracts, as the tape in DNKN was fairly bullish and had busted a couple of technical levels I was paying attention to. The following day on the official options expiration day, an influx of orders rolled through the 37.50 Calls and by the close on Friday, 9850 contracts had been traded on an open interest of 43:

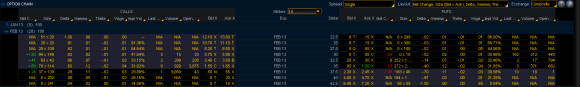

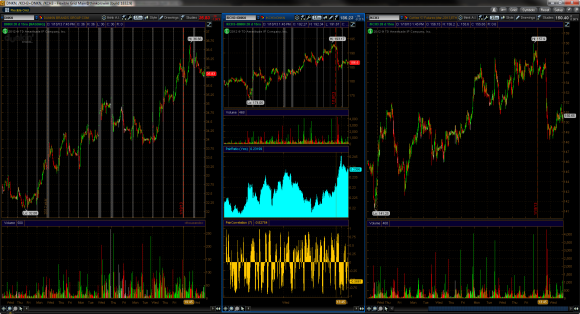

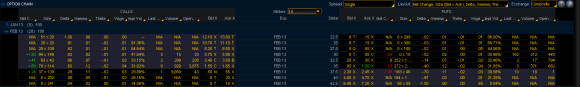

Gangbusters – I closed out a third of my position and was willing to see what we got going into the week ahead. When this activity continued through Tuesday and Wednesday, however, I realized that there was someone out there that has the same thoughts about earnings that I do, as this particular strike price became the most heavily traded of the entire chain (including other months that could have been traded):

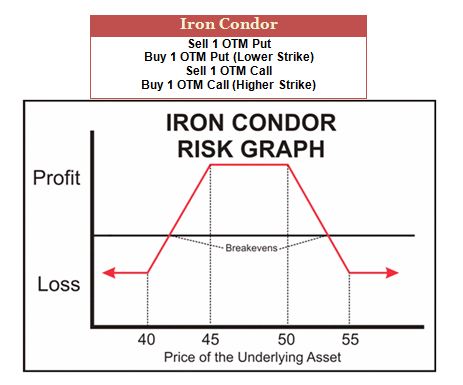

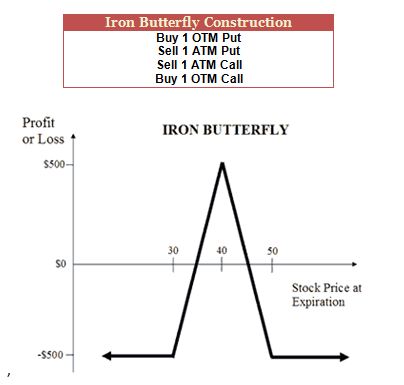

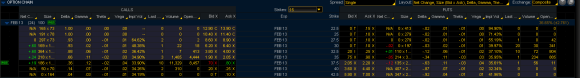

After closing out another third of my position on Tuesday, I continue to hold my final third and will continue to do so through the earnings report next week. Due to the elevated premium of the 37.50 Calls, I would be incredibly cautious about buying into this strike right now; a way to take advantage of this, however, would be to create a Vertical Spread on the February 2013 37.50 and 40.00 Calls if you share the same bias I do regarding the company’s earnings. Bring on the 31st!

– ZMoose

“Did You Know?” Dunkin’ Brands Fast Facts ; “Arabica Premium” Bloomberg Article ; Dunkin’ Donuts Announces Plans to Enter SoCal

** All other information regarding the company was found from the most recent 10K and 10Q reports **